Talking Leadership Industry Analysis #1

By Ben Davern | 3rd April 2025

Disruption Is Here—Are Leaders Asking the Right Questions?

Recent global shifts aren’t just trends—they’re tests. Tests of leadership, adaptability, and decision-making. The question isn’t whether change is happening. It’s whether leaders are asking the right questions:

- What assumptions about your business are already outdated?

- Where are you waiting for certainty instead of making a move?

- Are you actively shaping the future—or just reacting to it?

Here’s what’s defining the leadership landscape recently.

—

AI Regulation: Europe’s Balancing Act—Or a Competitive Handbrake?

Last month’s AI Action Summit in Paris highlighted the growing rift between Europe’s regulatory approach and the US’s no-guardrails model. While the risks and rewards around the latter have been well documented, it’s become clear that Europe’s regulatory-first approach is also a high-stakes gamble. John Clancy, founder of Irish AI startup Glavia, compared the Summit to “watching engineers redesign a jet engine mid-flight.”

Regulation is important—but is Europe overcorrecting at the cost of competitiveness? While the US and China race ahead in AI development, Europe is stuck in a balancing act between safety and speed. Ireland will increasingly find itself caught in the middle between these competing forces.

Yet this presents both opportunity and risk for leaders:

- Opportunity – Ireland could become a bridge between regulatory caution and AI acceleration, attracting companies seeking a stable yet innovative hub.

- Risk – If regulation outpaces practical business needs, companies may delay AI adoption, creating a competitive gap, which may lead to further risks:

-

- Slow adoption → competitive lag. Businesses waiting for regulatory clarity may fall behind global counterparts.

- Overregulation → talent drain. AI innovators could bypass Ireland for more flexible ecosystems.

- Missed opportunity → economic stagnation. Without bold leadership, Ireland could watch AI innovation rather than lead it.

Speaking to RTE, Mr Clancy suggested that Ireland should create a “CERN for AI”—a globally recognised hub for AI research and development. While a vital step towards mitigating the above-outlined risks, crucially this requires a joined-up approach between government, academia, policymakers and private industry – much like IMI suggested last year in our acclaimed whitepaper, Complex Leadership Challenges in the AI Age.

Ireland, positioned between competing forces, has a rare opportunity—but is it being seized? With good intentions but no clear roadmap, are we at risk of being left behind?

Leadership Imperative

AI isn’t a future problem—it’s a now problem, albeit with massive future consequences. For business leaders, the real question isn’t just about policy—it’s about whether AI strategy is being driven internally or dictated externally. Are leaders building AI readiness into existing strategies, or waiting for regulatory clarity that may never come? Unless leaders are proactively testing, experimenting and building AI into strategies, the risk of being left behind increases. The real competitive edge will go to leaders who can innovate within the guardrails—embedding AI into their operations while ensuring compliance.

AI Action Summit in Paris, February 2025. Source: the Guardian.

—

The Return-to-Office Debate: What If Leaders Are Solving the Wrong Problem?

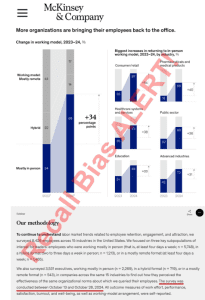

The latest McKinsey data suggests that 68% of companies have now returned to a primarily in-office model, up 34% since 2023. The message? The era of hybrid and remote work is fading.

Or is it?

Stanford’s Nick Bloom, a leading expert on hybrid work, has rebuked McKinsey’s research, calling its data misleading due to recall and sample bias. According to Prof. Bloom, many leaders want to believe that office work is resurging—because it validates their existing views on productivity and culture.

The contradictions are stark:

- McKinsey’s research shows that employee satisfaction is the same across remote, hybrid, and in-person setups.

- Leaders continue to overestimate their organisations’ effectiveness in collaboration and innovation—regardless of where work happens.

- Commercial real estate values are plummeting, according to McKinsey—a clear signal that office demand isn’t bouncing back as strongly as some claim.

So are companies truly returning to old models, or are leaders misreading the signals? If rigid return-to-office mandates aren’t improving outcomes, why are so many leaders doubling down? Is this about performance, or is it about control?

And do these questions matter?

Because the deeper issue isn’t where people work—it’s how they work. The focus should be redefining collaboration, culture and accountability—not arguing the merits of office vs hybrid vs remote. While rigid return-to-office mandates may drive more attrition than productivity, remote and hybrid conditions don’t necessarily lead to increased employee retention either as the Great Resignation a few years ago showed.

This isn’t about location—it’s about leadership.

Long-term, organisations that thrive will be those rethinking how work is done, how performance is measured and how teams collaborate.

Leadership Imperative

The challenge for leaders isn’t getting people back into the office, but rather how to redesign organisational environments to meet employee expectations, and how to foster innovation, inclusion and collaboration. Being in the office together under one roof still has a vital role to play, but it’s not a silver bullet for workplace culture. Leaders who force RTO without a compelling reason risk talent attrition, while those who default to hybrid without structure risk dilution of culture and collaboration. The best models are those designed around business needs, not blanket policies.

To truly unlock employee potential and ensure long-term success, leaders must foster a collaborative culture where employees are empowered to innovate and contribute fully. This requires a commitment to continuous learning and mentoring, along with ensuring every individual is aligned with the organisation’s mission, vision, purpose and values.

As a leader, is your focus on where people are, or how they perform? Are you leading for engagement and results, or defaulting to pre-pandemic nostalgia? Is your workplace strategy grounded in impact, or in assumptions about what “good work” looks like?

Nick Bloom refutes McKinsey’s Return-to-Office data. Source: Linkedin.

—

Commercial Real Estate: Ticking Time Bomb or Opportunity for Reinvention?

While one McKinsey report suggests companies are moving back to the office, another warns that demand for commercial space is collapsing.

According to McKinsey (US data):

- Office attendance remains 30% below pre-pandemic levels.

- Demand for office space is projected to drop 20% by 2030—putting up to $800 billion in property value at risk.

- Urban retail foot traffic remains 10-20% lower than pre-pandemic levels.

For leaders, this isn’t just a property issue. It’s about the future of how businesses operate. It’s about how workplaces are designed, how culture is built, and what the future of collaboration looks like.

- If companies continue shrinking their office footprints, what happens to the cultural fabric of cities?

- If commercial space becomes cheaper, will some businesses double down on highly-curated and experience-driven premium workspaces to attract and retain employees?

- If Irish cities follow US trends, will we see a new wave of real estate-driven business failures?

While McKinsey’s analysis is US-focused, the underlying trends are relevant to Ireland, where multinational companies set the tone for workplace policies. With multinationals downsizing office footprints, regional business hubs (Cork, Galway, Limerick) could face stagnation if commercial demand weakens. Meanwhile Dublin’s housing crisis could worsen if empty offices aren’t repurposed for residential use.

However, recent data indicates a positive shift in Dublin’s office market:

- Declining Vacancy Rates: The overall market vacancy rate peaked at 15.9% before the end of 2024 and has since decreased to 15.3% as of early 2025, with expectations of continued downward movement throughout the year and into 2026 (source: Knight Frank report).

- Increased Leasing Activity: A surge in office leasing has been observed, suggesting that the impact of remote working on the market may be diminishing to an extent (source: Irish Times)

While Dublin’s office occupancy is higher than in some major US cities, it remains well below 2019 levels. Global HQs of major US firms (Amazon, JP Morgan) are driving return-to-office (RTO) mandates that Irish employees must follow. Even if local leadership supports hybrid, a global RTO shift would force adjustments, impacting both talent attraction and office demand.

While McKinsey predicts an up to 20% drop in office demand by 2030, leading to potential oversupply and declining valuations, the impact will be felt unevenly. Prime office spaces with strong ESG credentials (high energy efficiency, wellness-focused design) should remain in demand, but older buildings with poor adaptability could struggle.

The ongoing shift towards hybrid and remote models also impacts hospitality and retail business, many of whom have traditionally relied on a CBD-based 9-5 workforce. As an RTE report mentioned last year, higher costs across energy, staff, insurance and rates are eroding profit margins for SMEs in hospitality and retail, while an RAI report claimed 612 hospitality businesses have been forced to close permanently since VAT was increased to 13.5% in September 2023. With rising costs and decreased footfall, many within hospitality and retail face great uncertainty.

Leadership Imperative

Leaders must assess whether they need the same footprint. Can space be repurposed for collaboration rather than traditional desks? The best leaders should focus on “the why” behind in-office work, not just mandates. Investing in high-quality, flexible office environments can enhance employee satisfaction and productivity, making the office a desirable destination for collaboration and innovation. Where possible, engaging with policymakers to repurpose underutilised office spaces can contribute to addressing housing shortages and revitalising urban areas.

—

Ireland’s Economic Crossroads: A Business Issue, Not Just a Policy One

The OECD Economic Survey of Ireland 2025 paints a complex picture. While economic fundamentals remain strong, housing shortages, skills gaps and infrastructure constraints threaten long-term competitiveness.

The report warns of looming economic challenges, including:

- Housing shortages threatening Ireland’s ability to attract and retain global talent.

- Infrastructure and energy grid limitations that could constrain business growth and expansion.

- Heavy reliance on multinational corporate tax revenues, creating long-term fiscal risks if global shifts occur.

For many business leaders, these may sound like government problems. But they aren’t.

- Talent availability is a business risk: If high housing costs drive skilled workers away, recruitment will suffer, particularly in sectors reliant on global talent pools.

- Regulatory gridlock on climate and infrastructure affects costs: Delayed action on energy security and sustainability means businesses face unpredictable pricing and supply chain disruptions.

- Overreliance on US multinational tax revenue is a corporate risk: If global tax frameworks shift, Ireland’s economic model could be shaken—affecting investment, expansion plans, and fiscal policy.

Talent is mobile. If Ireland can’t house, transport, or power its workforce efficiently, the next generation of skilled professionals will look elsewhere—whether to mainland Europe or remote-first firms with no geographic constraints.

At the same time, if foreign direct investment slows, and talent begins to migrate, Ireland’s position as a global business hub weakens. Companies dependent on a stable, high-skilled workforce may face operational and financial turbulence.

Leadership Imperative

Business leaders can’t afford to wait for policymakers to fix these structural issues. This isn’t politics—it’s risk management.

- Engage in policy conversations: Industry leaders must actively contribute to housing, energy, and taxation discussions, advocating for business-friendly but forward-thinking reforms.

- Think beyond immediate talent pipelines: Workforce challenges aren’t just about recruitment—they’re about long-term retention in a globally competitive talent market.

- Develop private-sector solutions: Companies that take proactive steps—co-investing in housing solutions, sustainability projects, or workforce infrastructure—will have a competitive edge.

Ireland’s economic success isn’t guaranteed. Businesses that act now to secure their operating environment—rather than waiting for crisis-driven intervention—will be the ones that thrive.

Paschal Donohoe and members of the OECD at the launch of the OECD Economic Survey of Ireland 2025 at IIEA headquarters, Dublin. Source: Linkedin.

—

CEO Optimism vs. Structural Risks: Is Transformation Moving Fast Enough?

The latest PwC CEO Survey presents an interesting paradox:

- 60% of CEOs expect economic growth to accelerate this year.

- 42% plan to expand their workforce.

- Yet, 42% also believe their company won’t survive the next decade without major reinvention.

Optimism is high—but so is the recognition that business models must fundamentally change. The problem? Change is hard, and most businesses aren’t moving fast enough.

- Many industries are still running on legacy systems, legacy thinking, and legacy structures—while disruption moves faster than adaptation.

- AI adoption is accelerating, yet trust in AI-driven decision-making remains low—slowing real transformation.

- Workforce expansion is planned, but skills shortages remain a massive bottleneck—raising questions about how realistic growth ambitions really are.

The biggest risk in 2025 isn’t recession—it’s stagnation. CEOs know reinvention is necessary, but is it happening fast enough?

Put another way, the leaders surveyed aren’t just concerned with incremental change. They know that without new business models, AI integration, and bold transformation, survival isn’t guaranteed. Yet many still rely on short-term efficiency gains instead of truly reshaping their organisations for the next decade.

And in Ireland, the challenge is even sharper:

- Talent pipelines remain constrained by housing shortages and an increasingly competitive global job market.

- Long-term infrastructure gaps limit the speed at which transformation can take place.

- Economic reliance on foreign direct investment means Ireland’s trajectory is partly shaped by decisions made outside of its control.

Leadership Imperative

The best leaders won’t just optimise for efficiency—they will redefine what success looks like. In this environment, adaptability and scenario planning are no longer just best practices; they are business survival strategies.

As a leader, are you truly driving transformation—or just assuming your current model will last another decade? The difference will decide who thrives in the next economic cycle—and who won’t be here to see it.